value appeal property tax services

This is where property tax appeal services can come in handy. Although it carries no legal weight its a low.

Online Protest Filing Williamson Cad

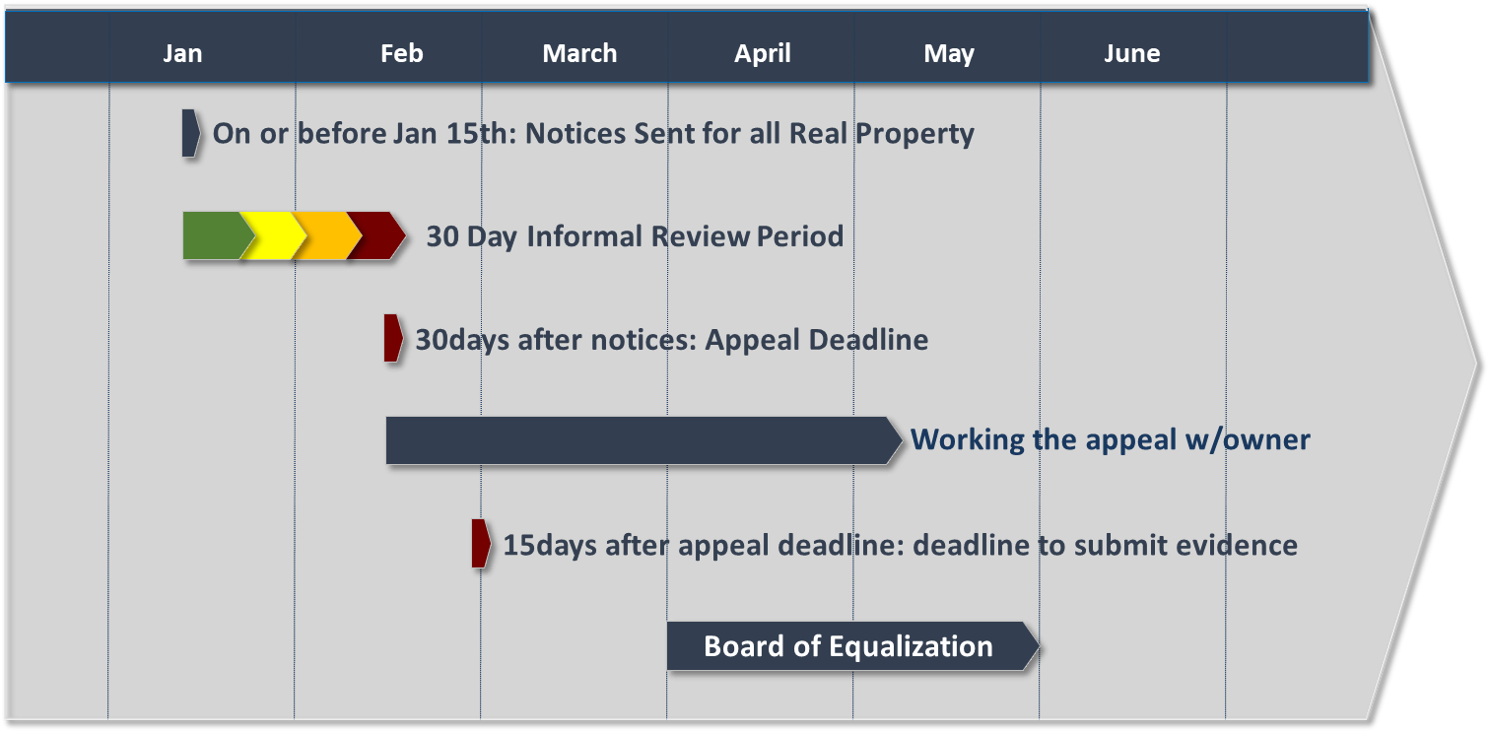

Here is what the timeline looks like in Arizona.

. They can help you assess the true value of your home and file an appeal to reduce your property taxes. The Trouble With Property Taxes in the US. Our specialists possess the local market expertise and experience necessary to achieve winning results.

Put our 25 years of Property Tax Knowledge Experience and Refund expertise working to save you money on your Property Taxes. Should You Appeal Your Property Tax Assessment. As property tax consultants we review assessments manage and seek solutions to reduce and control property taxes and prepare consulting reports or comprehensive appraisals based on the clients needs.

But perhaps best for you. County Websites For Property Tax Value Appeals Adams County 720-523-6038 Get value and account number using Quick Search search your street number and click on Valuation Summary. We went live for the first time in June 2009 and have since increased our coverage area to approximately 85 of the US population.

Our service provides an easy to understand benefit saving money to a huge market US homeowners. ValueAppeal is TurboTax for property taxes. Were proud of our thousands of happy customers who regularly use our easy no stress service.

It also generates property tax assessment appeal letters and can help you quickly create appeal packages including the appeal letter and any custom attachments you want to send. If you feel like your tax payments have become too much to bear DoNotPay can help you understand how to lower them in a blink of an eye. As you prepare your appeal you can also use TPT to capture market.

Valuation for Property Tax Appeals. By contesting your assessment you can enjoy a lower property tax. If you have value questions you may call 503 846-8826.

Property Tax Timeline in Arizona. Miami Tax Appeals specializes in residential commercial industrial and vacant land property tax appeals. And conveniently we also offer free property tax appeal evaluations too.

To appeal the assessed value and related property tax prepare yourself for a tough row. Call us today at 206 275-1100. ValueAppeal a company that charges a fee to assist consumers in appealing their property tax assessment has launched a platform designed to help finance and real estate professionals offer property tax appeal services.

Property valuations and taxes are calculated well in advance of the tax year when theyre due. For example assuming an assessed valuation percentage of 10 that means the average property tax rates are 087 to 15 of the actual full cash value. We always provide a no upfront fee policy.

However this can be a laborious process warns Consumer Affairs. The Board of Property Tax Appeals BoPTA is comprised of independent citizens appointed by the Board of Commissioners. We offer a powerful web based do-it-yourself tool that homeowners use to lower their property taxes.

Free Analysis Business Personal Property Tax Appeals Every person or company that makes use of such items as machinery equipment computers or furniture in a commercial industrial or agricultural enterprise must file a business personal property affidavit by April 30th of each year. Let our legal and appraisal experience work in your favor. In fact ValueAppeal CEO Charlie Walsh made the tough decision to shut down the service earlier this year saying the economics of helping homeowners challenge their tax bills for as little as 99.

Get your access key. The taxpayer may appeal any property valuation in the county so long as the taxpayer owns property in the county. Call Jackie at 720-523-6743.

In many cases the first step is to contact the tax office informally and seek to resolve the difference without filing a formal appeal. Dont forget you lose your right to appeal your property tax value this year if dont appeal by May 31 2021. Your proposed property tax notification will include an appeal deadline which can be as little as 30 to 45 days after you receive the notification but may be longer.

TPT keeps you informed and prepared by managing the important dates associated with all stages of the property tax cycle. You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website. If your assessing authority has an online property tax assessment tool complete it before continuing with your appeal.

Timeline For Property Taxes Carver County Mn

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Contesting Your Property Value Los Angeles County Property Tax Portal

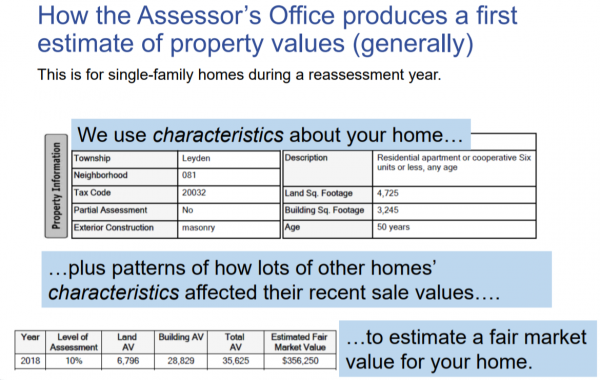

How Residential Property Is Valued Cook County Assessor S Office

How Do I Faqs About Appealing Assessments

Writing A Property Tax Assessment Appeal Letter W Examples

Here Is How To Write A Property Tax Appeal Letter Cut My Taxes

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Residential Property Tax Protest Services Swbc

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

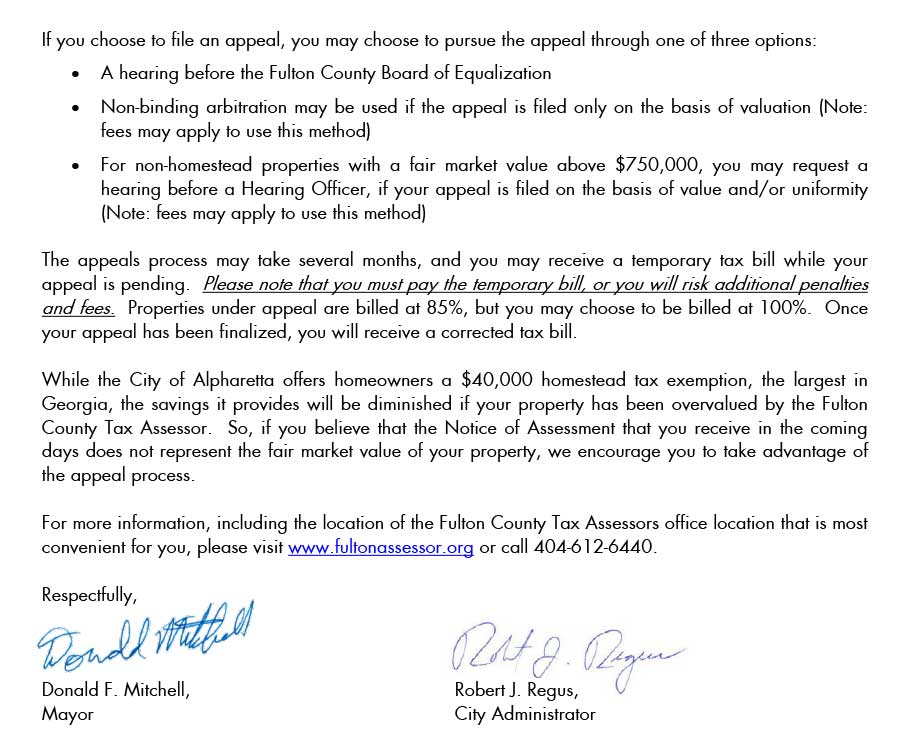

Mayor Advises On Property Assessment Appeals

Real Estate Property Tax Jackson County Mo

Property Tax Appeals When How Why To Submit Plus A Sample Letter