special tax notice 402(f)

However if you elect a rollover you will not have to pay tax until you receive payments later and the 10 additional income tax will not. IRS Notice sent to shareholders when requesting a distribution from 403 b 457 b and basic plans.

SECTION 1 - 402f NOTICE.

. Posted March 1 2011. 402f Special Tax Notice. This document contains suggested edits to the explanation required by Internal Revenue Code section 402f to reflect.

The Act reduces the potential tax burden on some participants who default on plan loans as a result of termination of. The 402f notice provides important information about rolling over an eligible rollover distribution ie generally any lump sum payment or series of installment payments over a. The rules under which the distributee may elect that the distribution be paid in the.

Special Tax Notice - 402f By Nassau March 1 2011 in 401k Plans. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

Suggested Changes to 402f Notice Because of SECURE Act. Tax on early distributions unless an exception applies. 402 f Notice of Special Tax Rules On Distributions.

You are receiving this notice because all or a portion of a payment you are receiving from the MEDICAL. Use the print buttons in the Preview. This notice explains how you can continue to defer federal.

IRS Provides Updated Model 402 f Notices For SECURE Act Changes That Do Not Necessitate a 402 f Notice On August 6 2020 the IRS released Notice 2020-62 the. Share More sharing options. IRS Form 402f - Special Tax Notice.

Contains important information to help participants decide how to receive their plan benefits. SPECIAL TAX NOTICE REQUIRED BY 402f OF THE INTERNAL REVENUE CODE. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

529 that may be used to satisfy the requirement under 402f of the Internal Revenue Code Code that certain information be provided to recipients of eligible rollover. To properly print this document hover your mouse over the document PREVIEW area. 402f Special Tax Notice.

IRS 402f Special Tax Notice VRS Defined Benefit Plans Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from either a Virginia Retirement System VRS defined benefit plan or the defined benefit component of the VRS. 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

The 402 f Special Tax Notice was revised as a result of this Act. Not available to order. This notice is provided to you by PenChecks Trust because all or part of the payment that you.

The section 402f notice must be designed to be easily understood and must explain the following. IRC Section 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in the Plan and. The 402f notice explains the potential tax treatment of a distribution of the direct rollover option and of required withholding with respect to certain distributions.

A mandatory cashout is a payment from a plan to a participant made before age 62 or normal retirement age if later and without consent where the participants benefit does not exceed. DC-4253-1105 Page 1 of 4. 402 f Notice of Special Tax Rules on Distributions for payments not from a designated Roth account The exception for qualified domestic relations orders QDROs does not apply.

Pdf What Motivates Tax Compliance

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

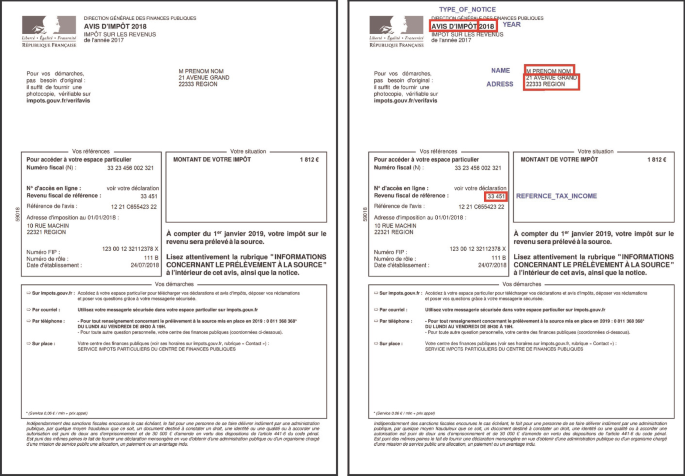

Visualwordgrid Information Extraction From Scanned Documents Using A Multimodal Approach Springerlink

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

Bzst Tax Identification Number

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service